entrée.AP Product Features

Managing and being fully in control of the cash flow of your food distribution operation, is of critical importance to your success. The entrée.AP add-on module is an Accounts Payable system which integrates fully with your entrée software to manage your business expenses, including received Purchase Orders. It provides the ability to generate checks, track credits, track discounts, track partial payments, track recurring obligations and reconcile your bank accounts. It includes a flexible "Approve to Pay" feature which lets you view just the invoices that meet your criteria (vendor, discount date, invoice date, etc.) and approve with just a click.

entrée.AP General Features

•Displays total accounts payable and approve-to-pay amounts.

•Allows unlimited partial payments on open invoices.

•Check voiding capability streamlines processing for lost checks.

•Permits 12 payment priorities to prioritize invoice payment.

•Vendors may be placed on payment hold.

•Allows an unlimited number of checking accounts.

•Allows you to create invoices manually, or match them up to purchase order receipts.

•Allows non-check payments of invoices, such as wire transfers.

•Built-in bank reconciliation options include sorting by date or check number for easy and efficient reconciliation.

•Flexible approve to pay feature lets you view just the invoices that meet your criteria (vendor, discount date, invoice date, etc.) and approve or unapproved with just a click.

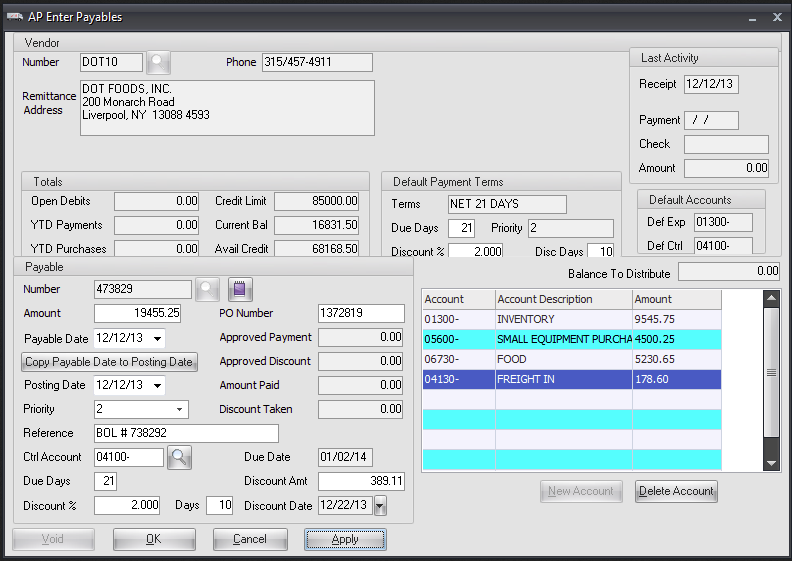

Entering Payables

The entrée.AP software module for Accounts Payable makes keeping track of your expenses easy and efficient. From one screen you can enter payables, debits, calculate discounts and optionally approve the payable for payment. When using the Purchase Order features of the main entrée system, once your vendors invoice is received, you can compare it to what was actually received on the purchase order, and then post it to entrée.AP with just one click.

When posting a received and approved Purchase Order, the system will automatically use the proper information from both the Purchase Order and Vendor file. Just enter your payable number, and entrée.AP will automatically fill in the proper amount, payable date, posting date, priority, due days, discount, purchase order number, discount and all other account information. You also have the ability to distribute the payment amount to multiple expense distribution accounts when necessary.

Some features of the Enter Payables screen include:

▪Last Activity: Allows you to see the last time you paid this vendor with date and check number.

▪Totals: Display your current balance, available credit and year-to-date purchases with the vendor.

▪Payment Terms: Your agreed upon payment terms with the vendor, including the discount percent you can take if paid within a certain number of days.

▪Default Accounts: The default expense and control accounts are displayed to ensure the payments will be expended to the correct general ledger accounts.

▪Payable: When posting a received and approved purchase order to payables the system will automatically use the proper information from both the purchase order and vendor file. Just enter your payable number, and entrée.AP will automatically fill in the proper amount, payable date, posting date, priority, due days, discount, purchase order number, discount and all other account information.

▪Multiple Distribution Accounts: You have the ability to distribute the payment amount to multiple expense distribution accounts when necessary.

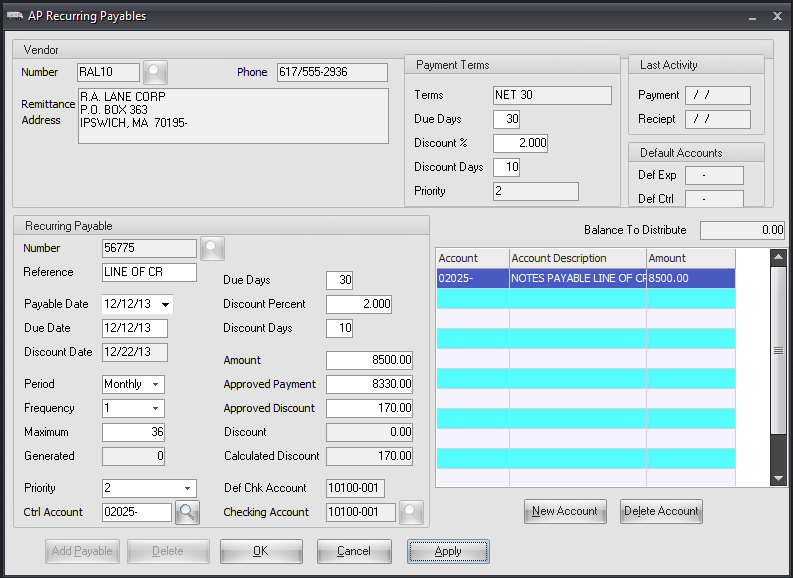

Recurring Payables

Some payables need to be created on a regular basis. Instead of entering those payables manually, you can create a recurring payable entry, and then use it to automatically generate the payables for you on a regular basis.

Examples of recurring payables could be a line of credit payment, monthly invoice for rent or leasing of equipment. Frequency options for recurring payables include daily, weekly, bi-weekly, monthly, bi-monthly, twice a year, yearly.

For simpler needs such as cutting or filleting, entrée can also automatically update inventory based upon a standard "yield %" defined.

Frequency options for recurring payables include:

▪Daily

▪Weekly

▪Bi-Weekly

▪Monthly

▪Bi-Monthly

▪Twice a year

▪Once a year

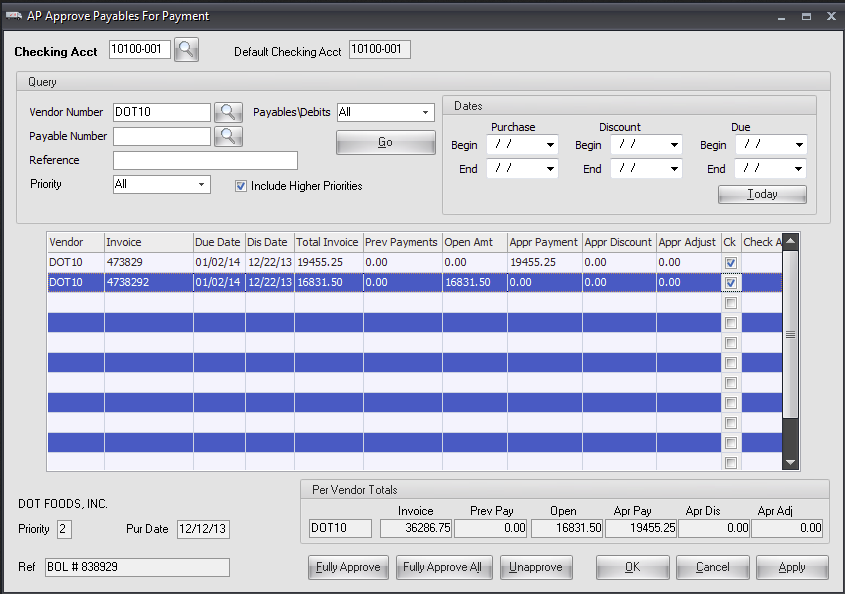

Account Payables

Once you have created a payable, you must approve it for payment before you can generate a check. The entrée.AP system allows you to approve all your payables from one screen, with just a single click for each invoice you approve.

You can either select a single vendor, or view all vendors when selecting which invoices to approve for payment. This option is also useful for displaying open payables that meet your entered search criteria, such as viewing all payables due on a certain date.

You have the ability to approve your payables by payable number, priority, purchase date, due date, and most importantly discount date to ensure you get all discounts when available.

It will display the Per Vendor totals for you at the bottom so you know exactly how much that check is going to be for your vendor.

As you approve payables, entrée.AP will keep a running total per vendor with approved discounts and/or adjustments.

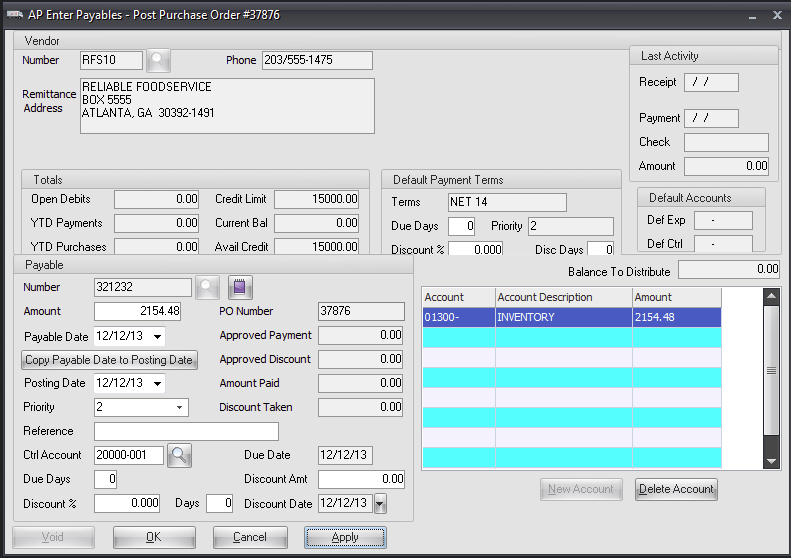

Posting From Purchasing

When closing a purchase order from the main entrée system, after all inventory has been received and approved, you have the option to post the transaction directly to entrée.AP.

At this time you will required to enter the vendors unique invoice number for the received goods.

This is a time saving feature which reduces the number of steps your purchasing and accounts payable departments have to deal, while ensuring accuracy of the payments issued to your vendors.

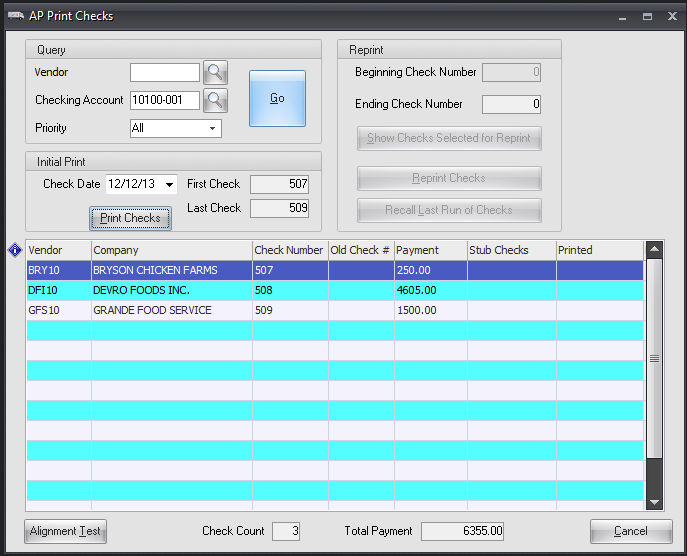

Print Checks

Once you create your payables and approve them for payment, you can then have entrée.AP generate checks and also void and re-print them if necessary.

Checks can be printed using either a standard dot matrix printer or laser printer, and can print on plain paper or pre-printed check forms. You can also define the layout of your checks by using our check printing formatting tools.

You can specify that checks print by vendor, checking account and priority.

The 'Initial Print' area of this screen will display the beginning check number and ending check number for this batch of checks. It also displays the check date which can be edited when needed.

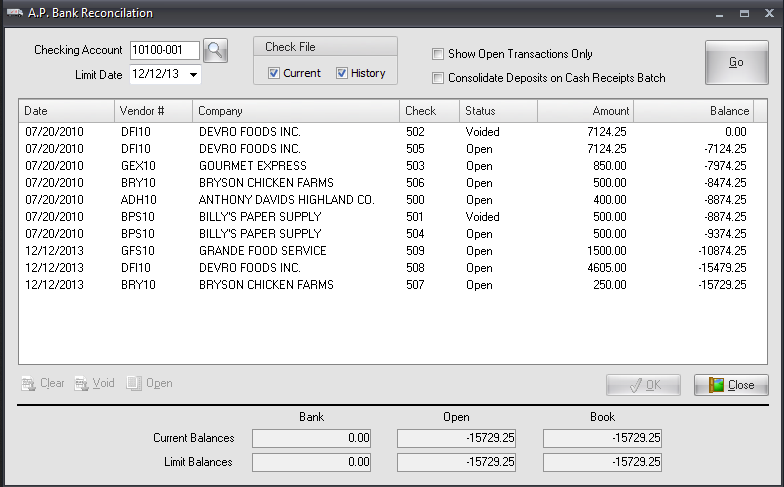

Bank Reconciliation

Bank Reconciliation allows you to reconcile your bank statements against information stored in entrée.AP. When you receive your bank statement, you compare the statement to the reconciled transactions and voided checks, cleared checks, cleared deposits and other charges. This ensures your checking accounts remain accurate with your bank. All your open transaction will be displayed with the ability to select multiple transactions. As you clear transactions, entrée.AP will display your running totals including Bank Balance, Open Balance and Book Balance.

Simply select your checking account and select 'GO'. All your open transaction are displayed with the ability to select multiple transactions at a time to clear.

As you clear transactions, entrée.AP will display your running totals including:

▪Bank Balance: The amount of all checks and receipts that are marked as cleared. This amount includes the balance forward total from your last reconciliation.

▪Open Balance: The amount of all checks and receipts that have not been cleared.

▪Book Balance: The sum of 'Bank' and 'Open' balances, which provides a more accurate amount of your current bank balance.

•Please visit our website at www.necs.com to learn about our other add-on modules, products and services.

•Contact our NECS Sales Department at sales@necs.com for more information.

•Contact the Tech Support Department at tech@necs.com for assistance.

•For information about current NECS software training classes use this link: necs.com/training.php

NECS, Inc.

322 East Main Street Third Floor

Branford, CT 06405

Office Hours: Monday - Friday from 8:30AM EST - 5:30PM EST

Toll Free: 800.766.6327 (NECS) Phone: 475.221.8200 Fax: 203.208.0889