Overview of the Cancel Cash Receipts utility

This section provides a quick reference for applying payments using the Cash Receipts by Customer utility.

| 1. | Enter the customer number, to cancel a cash receipt for, in the Customer Number field and press the Enter key. |

| 2. | Enter the check or reference number of the receipt in the Check Number field and press the Enter key. |

| 3. | Verify the correct receipt is loaded by validating the invoices that will be affected in the Invoice Grid. |

| 4. | Select one of the types of cancellation in the Cancellation Reason area. |

| 5. | Click the Apply button. |

•Clicking the OK button will cancel the currently loaded receipt and close the cancel cash receipts window.

•Clicking the Cancel button after a valid cash receipt has been loaded, but not yet applied, will prompt the user for confirmation to abort the cancellation.

•Clicking the Cancel button when a customer is loaded into the cancel cash receipts window, but without a valid receipt to be canceled loaded, will clear the currently loaded customer.

•Clicking the Cancel button when a customer is not loaded into the cancel cash receipts will close the cancel cash receipts utility.

Canceled Open Credit Scenario

When an open credit/discount payment is canceled, the monies are NOT returned to the open credit field in customer maintenance. This non-return happens because there is no paper trail for open credits/discounts in the entrée system.

If the open credit monies need to be returned to a customer's account you have two options:

a. Manually enter it either by using the Customer File > Customer Tab > Account Information sub-tab > Open Credits field.

or

b. Use the Cash Receipts feature in the Customer ribbon menu.

Important: If you the Security Management Miscellaneous password option #12 Allow application of overpayments as Open Credit in Cash Receipts unchecked for every entrée user account, then you will never need to deal with this Open Credit scenario.

Processing Open Credits in Cancel Cash Receipts

If the customer's current Open Credit balance is big enough to accommodate the *entire* canceled amount then that amount will be deducted directly from Open Credit and no Accounts Receivable entry will be required.

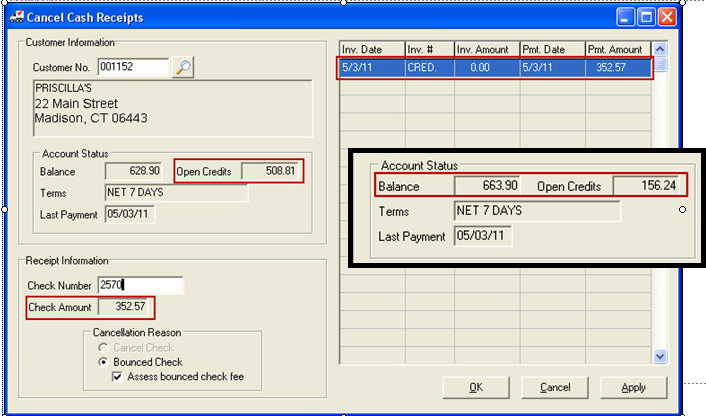

If the entire amount cannot be removed directly from Open Credit, (as in the example below), then a "CRED." entry will be created. We are not doing a partial "CRED." amount because maintaining a connection to the original receipt (by having the same transaction dollar amount) could be valuable during the audit process.

As you can see in the black outlined box below the Balance and Open Credits have been updated after the Apply button processed the Check Amount.