entrée.GL Product Features

The entrée.GL software is a general ledger system which integrates fully with the entrée system. It provides you with advanced general ledger and financial reporting, designed to meet the needs of today's food distributors. Entries can be posted to current or previous periods. Flexible report formats provide comprehensive financial, comparative, and audit trail options.

entrée.GL Main Features

•Allows posting to any periods in a three-year window.

•Enables you to designate custom groups of accounts for budgeting and reporting purposes.

•Allows you to consolidate, edit, and report information from multiple companies and various periods.

•Easy access to any account, including the ability to drill down to AP detail from any posting.

GL Reports

▪Balance Sheets

▪Chart of Accounts

▪File Listings of Recurring Entries, Account Groups, Types, etc.

▪General Ledger

▪Income Statements

▪Trial Balances

▪Unposted Transaction Edit Lists

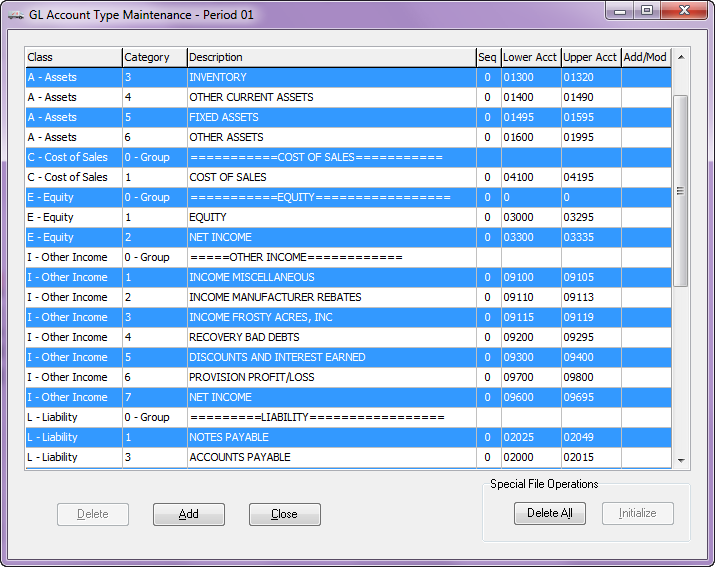

Account Types

The first step in initializing the General Ledger is setting up General Ledger Account Types. Account Types classify accounts by their accounting function, such as expenses, liabilities and assets. It also determines whether an account appears on the Income Statement or Balance Sheet.

Each account type has a class, a category, a description, a sequence number, a lower account number and an upper account number. The lower and upper account numbers are the account type range.

Class

The Class determines whether the account will appear on the income statement or balance sheet. Possible Class designations include:

▪Assets

▪Cost of Sales

▪Equity

▪Liability

▪Other Income

▪Sales

▪Taxes

▪Expenses

▪Report Labels (for reporting purposes only) Category. The Category allows you to create subtypes within each class. You can have up to 9 categories per class, excluding the Total and Group categories which are used solely for reporting purposes.

Sequence

The Sequence Number changes the order of account types when they are printed on reports.

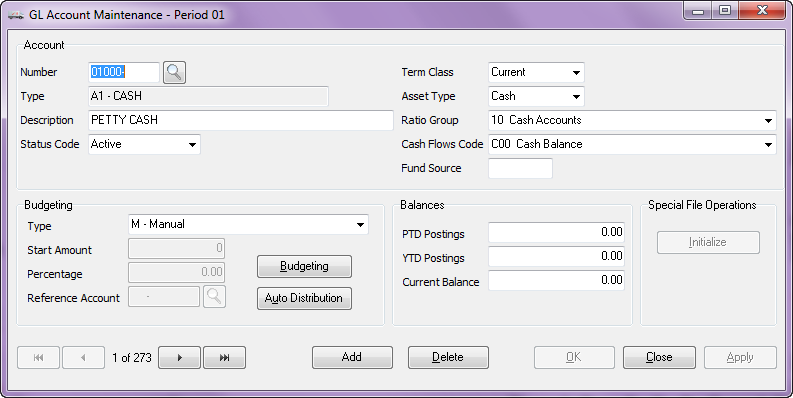

Account Maintenance

When defining your Chart of Accounts, each account and corresponding departments are defined on this screen. An account has a 5 digit account number, and an optional 3 digit Department, in the format “99999-999”.

A department of “000” is reserved for “Summary Accounts” which are created automatically when departments are enabled. Summary accounts consolidate information for an account group, and are used for reporting purposes only.

A department of “000” is reserved for “Summary Accounts” which are created automatically when departments are enabled. Summary accounts consolidate information for an account group, and are used for reporting purposes only.

A “Term Class” can be defined which is only associated with asset and liability type accounts. They allow the Balance Sheet to segregate accounts as either “current” or “long term”.

Budgeting and Auto Distribution can also be defined per account.

Auto Distribution

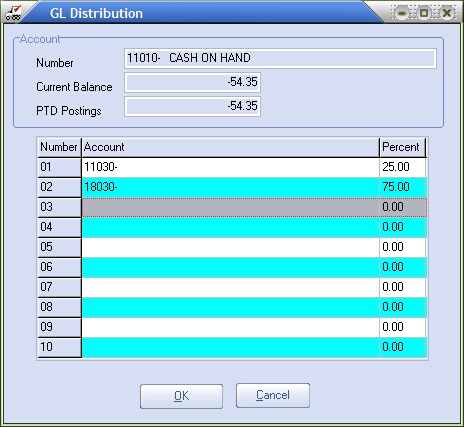

Automatic distribution allows you to distribute a journal entry amount for a particular account to pre-determined accounts with pre-determined percentages.

|

|

Budgeting

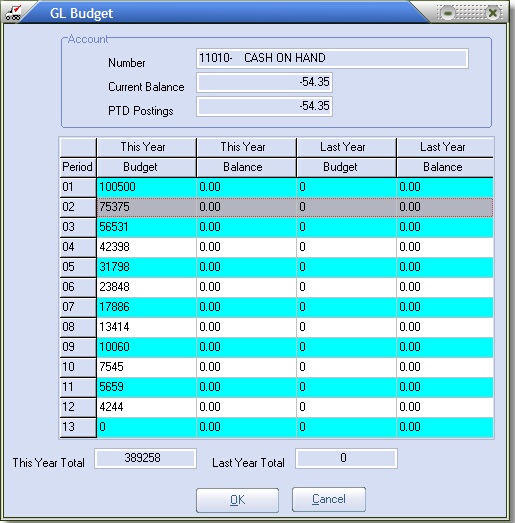

Budgeting allows you to enter amounts for any period for the current year, as well as the previous year.

You can define the budget amount for the current year and the system will track the current balance, the period-to-date postings, this year’s balance, last year’s budget and last year’s balance. |

|

Create Journal Entries

The journal is the record keeping device in which you record transactions. It is a chronological record of transactions, where each individual transaction is called a “journal entry”. A “journal entry” is a list of the accounts and the amounts posted to each account within the entry.

Prior to the Journal Entry window being opened, you will be allowed to enter a batch amount for the session. The batch amount allows you to verify journal entries by comparing the batch amount to the total debits of the journal entries.

A balanced entry has at least two detail items. The sum of all the debits and the sum of all the credits must cancel each other out for an entry to be balanced. Only balanced entries are allowed to be posted.

Search Postings

The “Search Postings” feature helps you quickly locate journal entry information posted to your General Ledger.