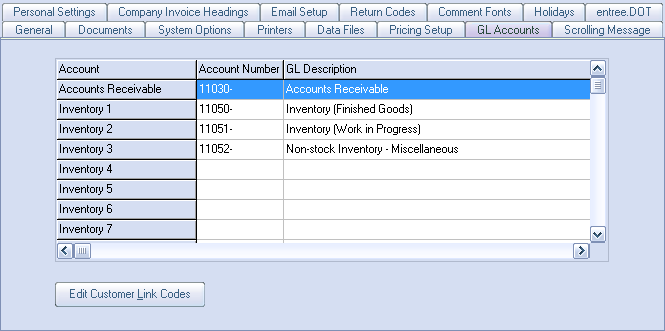

GL Account Grid

The GL Account grid is used to define the general ledger accounts that should be posted to when accounts receivable information is released from the entrée system.

Account

This read-only column displays the name of each of the available general ledger accounts that may be linked to the entrée system.

Account Number

This column is used to enter the actual general ledger account number that should be linked to the corresponding account.

•If the entrée.GL add-on module is installed, clicking the  search button in the Account Number column will the invoke the GL Accounts Search screen. The account entered must be already defined in the entrée.GL chart of accounts.

search button in the Account Number column will the invoke the GL Accounts Search screen. The account entered must be already defined in the entrée.GL chart of accounts.

•If the entrée.GL add-on module is not installed, any account can be entered.

GL Description

This column displays the GL account description as defined in the entrée.GL chart of accounts.

GL Accounts Chart

Account |

Description |

Accounts Receivable |

Standard account for posting monies owed from invoices.This number represents your accounts receivables posted for the defined date range when releasing the data to your General Ledger system. The amount the system posts to this number represents only the accounts receivable for the releasing date range.

This number is derived from the formula: sales dollars - cash receipts. For example, if you are releasing from 3/1/11 until 3/31/11, and your total sales for this time period was $1 million, and your total cash receipts for this time period was $900,000, then your accounts receivable amount would be $100,000. |

Inventory 1- 20 |

Standard accounts for posting inventory value. The entrée system allows you to define up to twenty separate Inventory accounts which will directly correlate to the Cost of Sales 1- 20 accounts. It posts the value of inventory sold for the release date range period.

For example, if you are releasing from 3/1/11 until 3/31/11, and your total cost of sales for the time period was $800,000, then your inventory amount would be -$800,000. Notice that the inventory account is debited (posted as a minus figure) rather than credited. |

Inventory Cost Adjustment |

This account is used for posting adjustments to the cost of inventory. |

Sales Returns |

Credits given for returned product are posted to this account.

When releasing to the general ledger, the total dollar value of credit memos processed for the releasing date range will accumulate into this account. This amount will post as a credit. You can prove out the dollar amount the system will post here by generating an Invoice Register for Credit Memos only for the releasing date range. |

Cash Receipts |

Standard account for posting monies posted to accounts receivable.

The system will total the dollar amount of cash receipts (cash & checks) for the releasing date range when posting to the general ledger. This amount will post as a credit. You can prove out the dollar amount the system will post here by generating a Deposit Slip report for the releasing date range. |

State Sales Tax |

All monies levied as State Sales tax are posted to this account. |

County Sales Tax |

All monies levied as County Sales tax are posted to this account. |

City Sales Tax |

All monies levied as City Sales tax are posted to this account. |

State Food Tax |

All monies levied as State Food tax are posted to this account. |

State Non-Food Tax |

All monies levied as State Non-Food tax are posted to this account. |

City Food Tax |

All monies levied as City Food tax are posted to this account. |

City Non-Food Tax |

All monies levied as City Non-Food tax are posted to this account. |

Sales Discount |

All credit monies given as a Sales Discount are posted to this account.

The Sales Discount is made up of both the discount amount (Discount %) assigned to specific invoices as well as the total amount of credits/discounts (Open Credits) applied while processing cash receipts. This amount is posted as a credit. |

Write Off |

Accounts Receivable entries that are relieved by performing a Write Off posting instead of an actual cash receipt are posted to this account. |

Bad Debt |

Accounts Receivable entries that are relieved by performing a Bad Debt posting instead of an actual cash receipt are posted to this account. |

Finance Charges |

Monies posted to the Accounts Receivable file that were the result of a Finance Charge are posted to this account. |

Bounced Check Fee |

Fees collected for bounced checks are posted to this account. |

Beverage Deposits |

All monies levied as Beverage Deposit are posted to this account. |

Abandoned Overpayments |

Overpayments that have been abandoned as part of the Cash Receipts entry are posted to this account. |

Fuel Surcharges |

When fuel surcharges are applied to a customer invoice they are posted to this account. |

Credit Card processing Fee |

Feature in Invoicing which is applied by adding Item Number "CCFEE" to the invoice. You may choose to define this item in your Inventory File or simply add it as a non-inventory line item.

|

Sales Shipping Charges |

The sales dollars from shipping charges of an invoice (items that have an item number beginning with SHIP) are posted to this account.

Represents the amount of sales dollars for products shipped to your customers. The system determines these sales amounts by looking at each invoice and determining if any of the items have an item number of SHIP. This SHIP item number is a special item code the system recognizes when invoices are processed. It will always refer to shipping charges for the specific invoice.

Shipping charges work on the assumption that the amount you charge the customer is the same amount as your cost. If this is not the case, it can be changed on a per invoice basis by using the F4 key on the Change Invoice screen while you are invoicing.

The shipping sales account is debited. |

Cost Shipping Charges |

The cost dollars from shipping charges of an invoice (items that have an item number beginning with SHIP) are posted to this account.

Represents the cost of sales dollars for shipping product to your customers. The system determines these sales amounts by looking at each invoice and determining if any of the items have an item number of SHIP. This SHIP item number is a special item code the system recognizes when invoices are processed. It will always refer to shipping charges for the specific invoice.

Shipping charges work on the assumption that the amount you charge the customer is the same amount as your cost. If this is not the case, it can be changed on a per invoice basis by using the F4 key on the Change Invoice screen while you are invoicing.

The shipping cost of sales is credited. |

Suspense Account |

This account is used to ensure the ledger balance. If a discrepancy is found in one or more of the other accounts, the postings in question will be placed in the suspense account. |

Case Item Surcharge |

supports Modification # 933 |

Non-Case Item Surcharge |

supports Modification # 933 |

Sales Account 1- 20 |

The sales dollars from items sold on an invoice are posted to these accounts. The entrée system allows you to define up to twenty separate Sales Accounts.

Most distributors use this area to post different categories of items. This is more meaningful than seeing a single sales lump sum amount. For example, a full line distributor might want to break down sales by MEAT, CHEESE, PRODUCE, DRY GOODS, SEAFOOD, PAPER, etc. The system knows how to break down these amounts by cross referencing the sales defined in the Inventory file.

If you enter an account code the system does not recognize in the Inventory file, any sales for this item will be accumulated into the main sales account (the first sales account defined on this screen). If you are linked to the General Ledger system, when editing any of these fields you can hit the F1 key to enable the Chart of Accounts search screen. This will help you quickly find the proper account code. Note that after you enter each sales account code, at the bottom of the screen you can define a brief description of the code. This description is used later when releasing postings and generating a Posting report.

The Sales Accounts will post as a debit to the General Ledger. You can prove out the total amount of sales by generating an Invoice Register for the same date range as the releasing date.

Note that when calculating the dollar amount when releasing to the general ledger, the system will examine each line item on every invoice and summarize the sales amounts using the unit and extended price as printed on the invoice. |

Cost of Sales 1- 20 |

The cost dollars from items sold on an invoice are posted to these accounts. The entrée system allows you to define up to twenty separate Cost of Sales accounts.

Most distributors use this area to post different categories of items. This is more meaningful than seeing a single sales lump sum amount. For example, a full line distributor might want to break down their cost of sales by MEAT, CHEESE, PRODUCE, DRY GOODS, SEAFOOD, PAPER, etc. The system knows how to break down these amounts by cross referencing the cost of sales accounts defined in the Inventory file.

If you enter an account code the system does not recognize in the Inventory file, any sales cost for this item will be accumulated into the main cost of sales account. If you are linked to the General Ledger system, when editing any of these fields you can enable the chart of accounts search screen. This will help you quickly find the proper account code. Note that after you enter each cost of sales accounts code, at the bottom of the screen you can define a brief description of this code. This description is used later when releasing postings and generating a Posting report.

The cost of sales accounts will post as a credit to the general ledger. You can prove out the total amount of cost of sales by generating an Invoice Register for the same date range as the releasing date and specifying that the Cost of Sales be printed as one of the columns.

Note that when calculating the dollar amount when releasing to the General Ledger, the system will examine each line item on every invoice. The system uses the base cost at the time the invoice was created (unless specified differently by the data entry operator) to determine the proper cost of sales. |