Mod #1419 Sweetened Beverage Tax

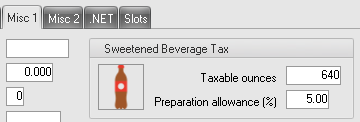

•The tax is charged on a "dollars per ounce" basis indicated in the “Taxable Ounces” field.

•For products like syrups and powders the "Preparation Allowance" will be used for tax calculations.

•The Preparation Allowance % discounts the tax on these products to allow for losses in producing the final beverage. (NECS have given this feature the name "Preparation Allowance" as it does not seem to have an "official" name in any of the documentation available to us at this time.)

Updates

V4.1.3 Updated the Commodity report to include the following fields to support reporting on SBT.

•Sales Tax Charged: Total tax on Non-SBT items only

•SBT Taxable Sales: Total sales of SBT taxable items

•SBT Total Tax Charged: Total tax on SBT items

•Non-SBT Taxable Sales: Total sales of Non-SBT items

V4.0.43.1

1.Sweetened Beverage Tax mod updated to add support for tax reporting.

2.Taxable Ounces field added to print, group and sort by options for all Inventory reports.

3.Taxable Ounces and Extended Taxable Ounces fields added to print, group and sort by options for all Sales reports that display Item Details.

entrée Features

•Inventory File Maintenance: Set the number of “Taxable Ounces” for each individual product on the Misc 1 tab. The tax is charged for whole ounces so any decimal values must be adjusted.

•Inventory File Maintenance: On the Misc 1 tab in the "Preparation Allowance" field set the percentage value for the products that fall into this category per the Ordinance.

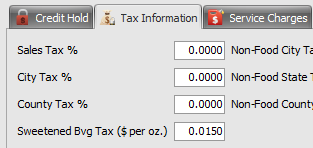

•Customer File Maintenance: On the Customer Tab Tax Information sub-tab use the Sweetened Bvg Tax ($ per oz.) field to set the tax rate for each customer.

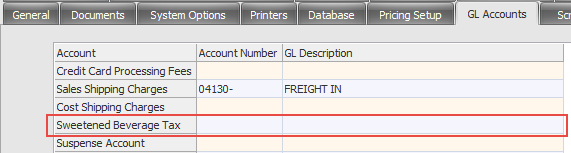

•System Preferences: On the GL Accounts tab a dedicated GL Account definition has been added for the tax. It must be filled in if you plan to use the Sweetened Beverage Tax.

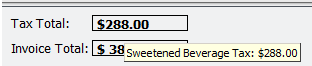

•Invoicing: To calculate the tax amount charged to your customer the "Tax Rate" specified in the Tax Information sub-tab is multiplied by the "Quantity Shipped" and then multiplied by "Taxable Ounces".

Formula 1: Customer Tax Amount = ((Tax Rate x Qty Shipped) x Taxable Ounces)

•Invoicing: When the "Preparation Allowance %" is applicable the deduction will be calculated from the Customer Tax Amount just generated.

Formula 2: Allowance Deduction Amount = Customer Tax Amount x Preparation Allowance %

Formula 3: Tax w/Prep Allowance = Customer Tax Amount - Allowance Deduction Amount

•Rounding: Takes place at the end of all calculations impacting the final tax amount.

•Printed Invoices: Per the Cook County ordinance the line items having this tax applied must have the tax amount included in the Extended Amount value on the invoice. A second line will be printed immediately below each taxed item on the invoice indicating the amount of the tax that was included in the Extended Amount.

•Release to GL Utility: This utility has been updated to recognize and segregate the Sweetened Beverage Tax amounts into the specified account.

•Tax Reporting: Updated this report to recognize and report on the Sweetened Beverage Tax.