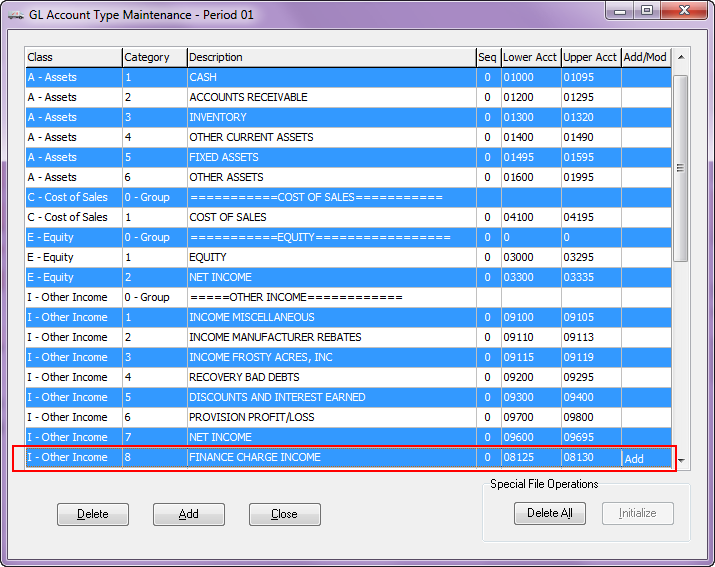

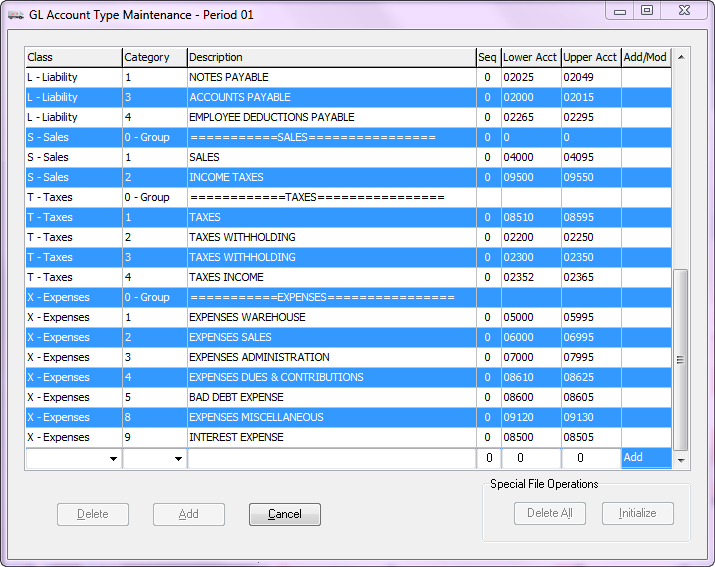

Adding an Account Type

Each account type consists of a class, a category, a description, a sequence number, a lower account number, and an upper account number. The lower and upper account numbers constitute the account type range.

When you want to add an account type click the Add button. The grid will display drop down menus and controls that will allow you to initialize the new account type.

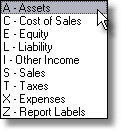

Class

The class determines whether an account within that class will appear on the income statement or on the balance sheet. The class describes the accounting function of any account that falls within that class.

Click the drop down button and choose the class for this new account type.

There are eight classes excluding class "Z", which is used solely for reporting purposes. |

|

Category

The category allows you to create subtypes within each class. You can have up to nine categories per class. Click the drop down button and choose the category for this new account type.

There are nine categories, excluding Total and Group, which are used solely for reporting purposes.

You can sub-divide Liabilities into two account types, L1 - Current Liabilities, and L2 - Long-Term Liabilities. If all Liabilities fall under one account type, you might simply label that account type L1 - Liabilities.

You can sub-divide Liabilities into two account types, L1 - Current Liabilities, and L2 - Long-Term Liabilities. If all Liabilities fall under one account type, you might simply label that account type L1 - Liabilities.

Account types with a class of "Z", or with a category of "0" or "T", are reserved types for group and total labels, and report headings on reports.These reserved account types have neither a sequence number, nor an account range.

Account types with a class of "Z", or with a category of "0" or "T", are reserved types for group and total labels, and report headings on reports.These reserved account types have neither a sequence number, nor an account range.

Description

Here you can enter an account type description up to 35 characters long, such as "Current Assets". This field may be left blank.

Sequence

The sequence number can be any number from 000 to 999. The sequence number changes the order of account types, and therefore the accounts within the account types, when they are printed on reports. Usually, accounts types are printed in order of the account type itself (A1, A2, E1, L1,..Etc.). The sequence number allows you to alter the printing sequence. Simply enter a "1" to maintain the order determined by the account type itself.

Lower Account

The lower account number represents the lowest account number that can fall within the account type. Only the account major portion of the account number is considered.

Upper Account

The upper account number represents the highest account number that can fall within the account type. Only the account major portion of the account number is considered.

There exist several constraints on the account range that must be met when editing.

▪The lower account number must be less than the upper account number.

▪Neither the lower nor the upper account number can overlap into another account type range.

▪Both the lower and upper account numbers must be five digits long, in the range of numbers from 00001 to 99999 inclusive.

•Reserved account types have neither a sequence number, nor an account range.

•A new account type is automatically saved to the account type file when you tab off the Upper Account field.