Closing General Ledger

|

This section only applies to customer's who have purchased and installed the optional entrée.GL (General Ledger) add-on module.

|

At the end of an accounting period, or at the end of the fiscal year, you must close the period or year. Closing calculates the net profit or loss for the period or year, updates balances, and creates historical information. Closing General Ledger also allows you to remove voided journal entries and old historical records.

At the end of the accounting period, closing the period ensures the year to date and period to date totals for the accounts remain current. When you close a period, current balances from expense and income accounts are accumulated in the net income account, and the expense and income statement account current balances are set to zero. Thus, the net income account contains the total net income for the period. The period to date balances for all accounts are also set to zero.

Access

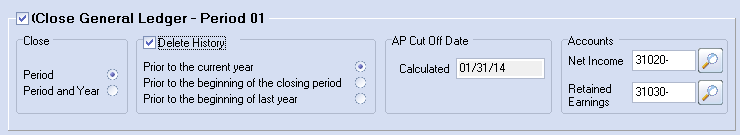

Use menu path: System > Closing > Close Period > go to the Close General Ledger section at the bottom of the window.

Overview

When the Close General Ledger Period process starts, a series of tests are performed to verify that General Ledger is in the correct state prior to closing.

•If any non-voided entries exist on the unposted entry file, you will receive a warning, which will prevent you from closing the period.

•If the period you are closing is period 12, you are warned, and allowed to cancel closing the period by clicking the "No" button. This allows you to close the year instead of the period.

•If the period you are closing is period 13, you will receive a warning, which will prevent you from closing the period.

Prior to Closing GL

Primary financial reports should be generated like the GL Journal Register.

The General Ledger files should be backed up prior to closing the year.

Run a full set of entrée system system backups.

|

The GL closing process is not date driven and can only close the "current" period.

|