Edit Tax Codes

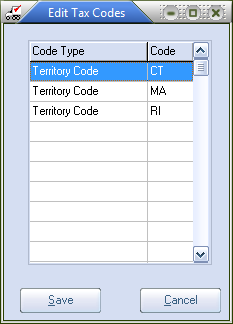

entrée will allow you to define up to twenty specific customer territories or industries to be taxable. The purpose of these codes is to provide greater flexibility as to who is taxable when purchasing this item.

•When tax codes are defined, only customers that have an industry or territory code that match the defined tax codes for the item will be charged tax. |

|

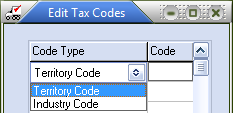

•To add or edit the tax codes, click the Edit Tax Codes button. |

|

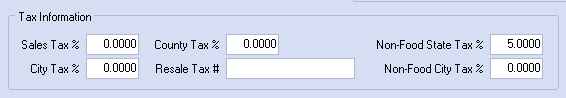

The following steps would be taken under this premise.

3. Click Save in Edit Tax Codes. 4. Click Apply for the item in the Inventory File Cost/Price tab.

6. Go to the Customer Tab and enter the tax code for each customer doing business in the taxable state or county.

7. The tax code is entered in either the Territory or Industry field, depending on the Code Type.

|