AP Close Period / Year

Closing the period ensures that period- to-date and year-to-date total in the vendor files remain accurate. You can close the period as often as you like, depending on the accounting period your company uses.

•You close the Accounts Payable at the end of each period to ensure that period-to-date and year-to-date totals in the vendor file remain accurate.

•Closing moves the current period's information into the vendor history file so the vendor history is accurate.

•Closing removes completed transactions, such as paid or voided invoices, from the current files. This allows you to control the amount of information that appears on current period transaction reports.

•When you close the last period of the year, you should close both the period and year.

•If General Ledger is enabled, you should perform a release to General Ledger just before you close the Accounts Payable period.

•Closing without the summary update and without history deletion allows you to transfer current transactions into the history files, without modifying the period-to-date totals. So if you have a large number of transactions, you can close in this manner on a daily basis, so that when the time comes to close and update period-to-date totals, you won't have so many transactions that will have to be moved to the history files.

•Bank Reconciliation - If you use Bank Reconciliation you should generate the Bank Reconciliation report before closing.

entrée V3

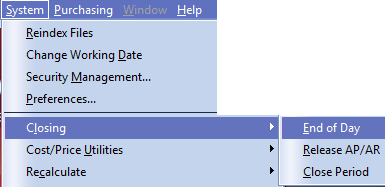

Use menu path: System > Closing.

Select from: ▪End of Day ▪Release AP/AR ▪Close Period

|

|

entrée V4 SQL

Go to the System ribbon menu System File section click Close Period.

Step to do Prior to Closing AP

•If you use Bank Reconciliation, you should generate the Bank Reconciliation report before closing.

•Run the AP Master Journal report.

•Run a full set of entrée system system backups.

•Run the Release to General Ledger.

Close Period Overview

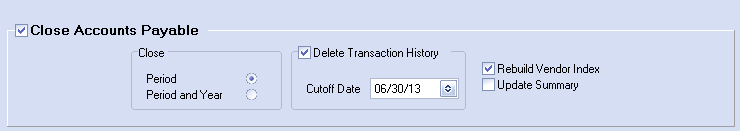

1. Select Close Accounts Payable and make your selections from the following options:.

▪Select a Closing Type: Period or Period & Year

▪Check Rebuild Vendor Index.

▪Check Delete Transaction History if you want to delete these records.

If you have checked the Delete Transaction History option you will this Confirm message: "All payable history information up to and including the deletion cutoff date will be lost. Continue close?" Click "No" to stop the closing process if you do not want this data deleted.

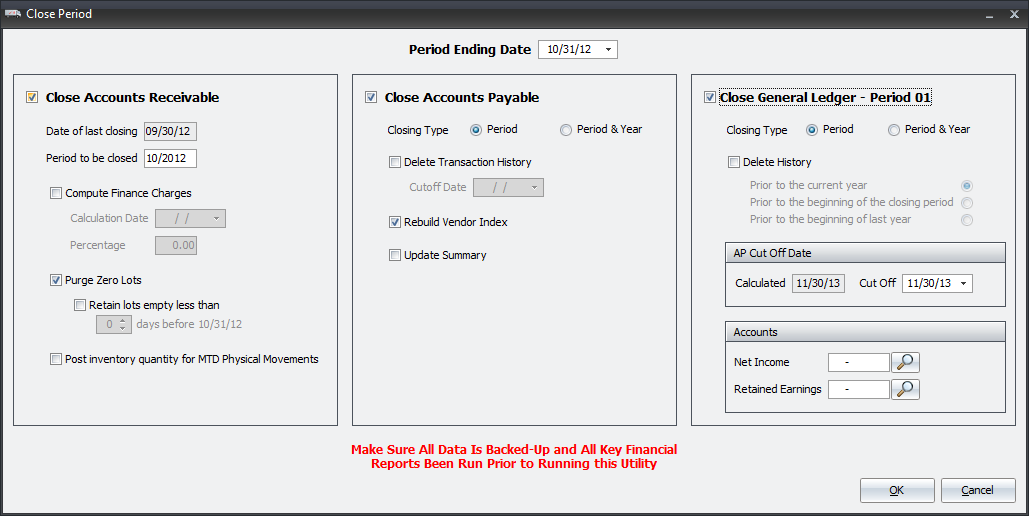

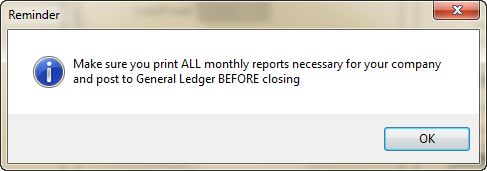

2. Click OK and first the Reminder message is displayed.

3. When you click OK on the Reminder you get the Close Period screen shown above. Select your date and options for the closing process and click OK.

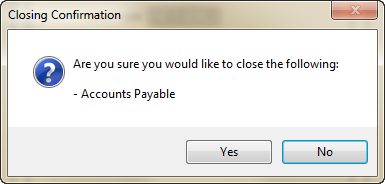

4. When you begin the Close process you may see a series of messages. First the Closing Confirmation message. Click Yes to continue with the closing. Click No to stop the closing process.

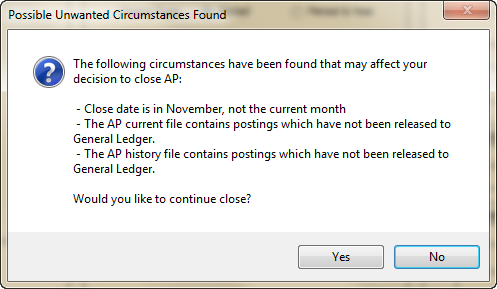

5. Then the system will perform some checks and the Possible Unwanted Circumstances Found message will display if problems are detected.

▪Click Yes to continue with the closing process if no major issues are found.

▪Click No to stop the closing process and resolve any issues listed here that may impact the integrity of your accounting data before proceeding. Then restart this Close process once problems are resolved.

In the example here you can see we have not released AP postings to the General Ledger which is needed before AP can be closed for the period.

In the example here you can see we have not released AP postings to the General Ledger which is needed before AP can be closed for the period.

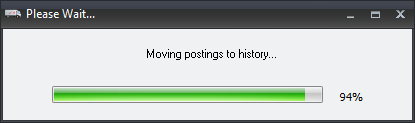

6. If you click Yes to continue with the closing the Please Wait... process a progress bar will display showing you what tasks are being performed.

7. When the process is done the Closing Complete message box will display Closing completed successfully. Click OK and return to the main entree menu.

See the Closing Warnings section to get familiar with possible warning messages you will see during this process.

See the Closing Warnings section to get familiar with possible warning messages you will see during this process.

Tasks Performed During the Closing Process

•Clearing History Files - Deletes records from the payables, distribution, and check history files up to and including the Deletion Cutoff Date.

•Moving Checks to History File - Moves checks to the check history file and clears the current check file. Only checks whose check date is less than or equal to the close date will be moved to the history file.

•Moving Distribution Records to History File - Moves distribution records to the distribution history file and clears the current distribution file. Only distribution records whose date is less than or equal to the close date will be moved to the history file.

•Moving Payables to History File - Copies open payables to the history file, and moves voided and paid payables to the history file. Only payables whose purchase date is less than or equal to the close date will be copied or moved to the history file.

•Updating Vendor History - Moves year-to-date into the history file.

•Updating Vendor File - Period-to-date balances are reset, and if closing the year as well, year-to-date balances are reset.

•

•Updating Bank Reconcile File - Accumulates the amounts from cleared transactions into the balance forward transactions, deletes all cleared and voided transactions, then packs and re-indexes the bank reconcile file. Only cleared transactions whose cleared date is less than or equal to the close date will have their amounts accumulated in the balance forward transaction, and then deleted. Voided transactions are deleted regardless of the date.

•Update System File - The SYSDATA file is updated with the new period.