Overview GL Close Processes

The following chart details each step entrée performs when closing an entrée.GL period.

Process |

Description |

Post net income |

Net profit or loss is posted to the net income account.

|

Print the General Journal Register |

The General Journal Register Report window will be opened to allow you to print the report. This process will only run when there exists at least one manually created entry on the posted entry file.

|

Delete History

|

If the Delete History option is enabled historical entries, based upon the selected deletion method, are deleted. Then entries from the posted entry file are copied to the entry history file.

|

Update balances and budgets |

The current balance is set to zero for all income statement accounts, and the period-to-date balance is set to zero for all accounts.

|

Update Entry History and and Unposted Entry File |

Amounts for entries on the posted entry file are reversed, provided the entries require reversal. Voided entries from the unposted entry file are moved to the entry history file.

|

Re-Index General Ledger files |

The unposted entry file, the posted entry file, the entry history file, the account file, the department file, the recurring entry file, and the account type file will be re-indexed and any records marked for deletion will be deleted. |

Update System File |

The SYSDATA file is updated with the new period. |

Warning Messages

When you first open the Close Period window, a series of tests are performed to verify that General Ledger is in the correct state prior to closing. Various warning messages will be displayed and the problems must be resolved before the closing will run successfully. Some common warnings are listed below.

•"All entries must be posted before continuing with the close."

If any non-voided entries exist on the unposted entry file, you will receive this warning, which will prevent you from closing the period.

Click No to stop the closing and fix the unposted entry file.

•"You are about to close period 12 into period 13. Any auto reversing entries will go into period 13. If your intent is to close the year rather than the period, you may select Period and Year instead of Period. Continue?"

If the period you are closing is period 12, you are warned, and allowed to cancel closing the period by clicking the "No" button. This allows you to close the year instead of the period.

•"To close period 13 you must do a Period and Year closing."

If the period you are closing is period 13, you will receive a warning, which will prevent you from closing the period.

•You are warned if you have requested deletion of history entries, where the message displayed depends upon which one of the three history deletion options you have selected. In this case, the second option, prior to the beginning of the closing period, was selected.

•You are warned if you have performed a release to General Ledger from Accounts Payable without updating General Ledger.

•A message reminds you that the printer must be ready to print the GL Journal Register report.

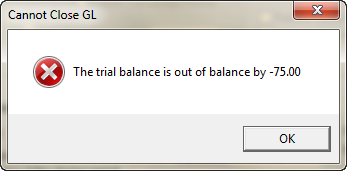

•The current balance of all accounts (including inactive and summary accounts) is summed, and you will be warned if there is an imbalance (the sum does not equal zero).

If General Ledger is unbalanced, you will not be able to close the period.

|

|