Mod #1382 Sugar Beverage Tax

The Sugar Beverage Tax (SBT) modification is derived from Mod #908 for Customer specific Bottle Deposits.

•Changes to support Mod #1382 Sugar Beverage Tax:

▪Inventory File: Added the SBT field to the Misc1 Tab to enter the tax amount for the item.

▪Customer File: The “Use Sugar Beverage Tax” option has been added to the Miscellaneous tab in options list so the tax can be activated on a per customer basis.

▪Updated entrée to enable printing the “SBT Tax” on invoices and in reports.

•Reports:

▪Customer Listing Report - Changed the caption of the bottle deposit column to "SBT Customer” in the report layout to indicate if SBT is activated for a customer.

▪Sales Commodity Report - The Sugar Beverage Tax option was added to the Sales Commodity report to filter customers with SBT items only.

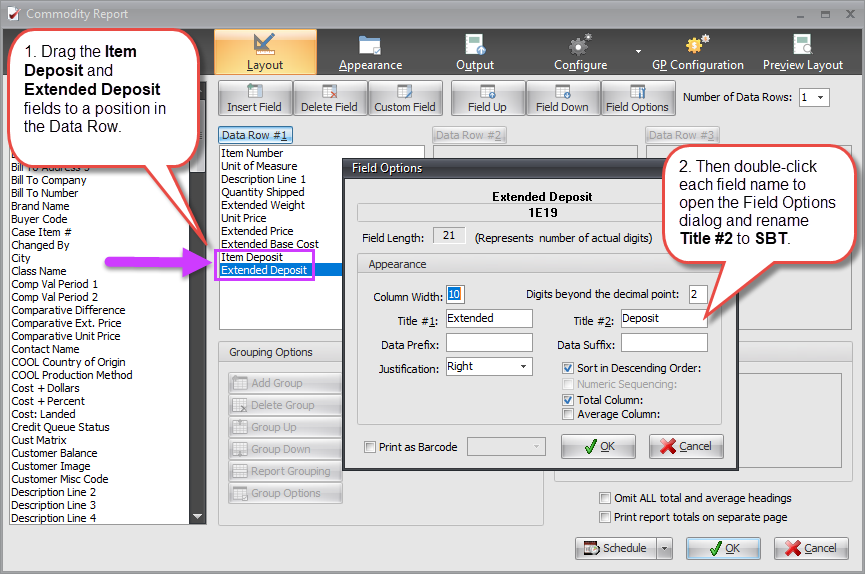

a. In the Commodity Report to see your beverage tax data you must add the Item Deposit and Extended Deposit fields using the Re4 Layout screen.

b. You can rename the fields that display in your report: Item Deposit becomes "Item SBT" and Extended Deposit becomes "Extended SBT".

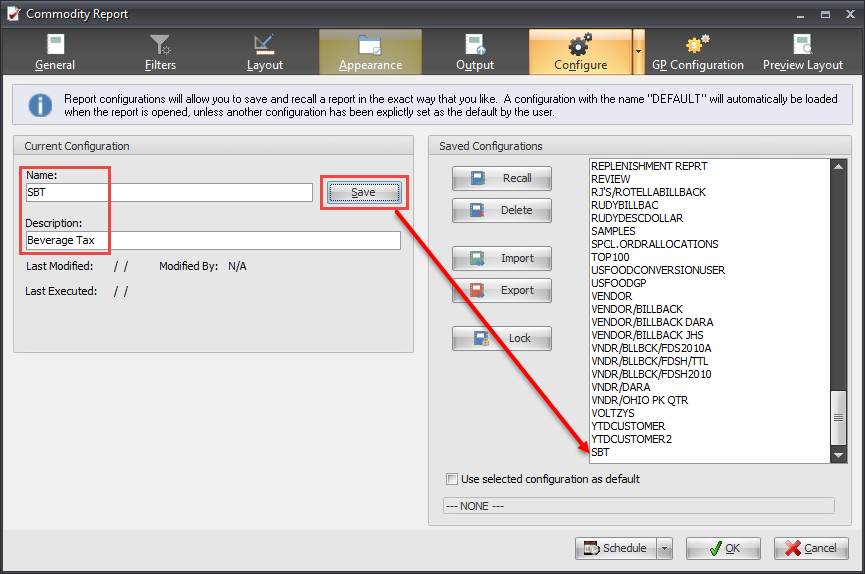

c. Use the Re4 Configure screen to save your SBT report configuration for future use.

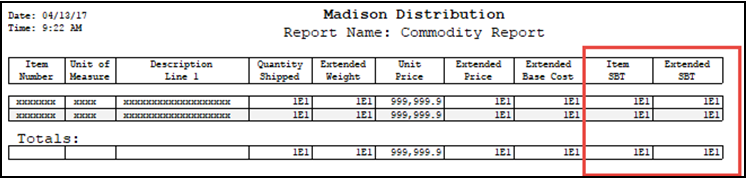

Use Preview Layout to see the new column names and position.

Use Preview Layout to see the new column names and position.

Mod #908 must also be enabled for the Sugar Beverage Tax modification to work.

Mod #908 must also be enabled for the Sugar Beverage Tax modification to work.

The bottle deposit mod #908 adds the “Use Sugar Beverage Tax” option to the customer options list on the "Miscellaneous" tab in Customer File Maintenance so the tax can be customer specific.

V4.0.40 Changes to Mod #908 to support Mod #1382 Sugar Beverage Tax:

•Changes the Bottle Deposit modification into Sugar Beverage Tax (SBT).

•Updates entrée to enable printing the “SBT Tax” on invoices and in reports.

•Customer Listing Report: Column added to indicate whether a customer has SBT activated.

•Inventory File: Adds the SBT field to the Misc1 Tab to enter the tax amount for the item.

•Mod #908 adds the “Use Sugar Beverage Tax” option to the customer options list on the Miscellaneous tab in Customer File Maintenance so the tax can be customer specific.