Close GL Steps & Data Validation

When the close general ledger period process is started entrée performs a series of checks to ensure the closing process will complete without error. This section will detail each of the checks that are performed.

•You are warned if have performed a release to General Ledger from Accounts Payable without updating General Ledger.

•You are warned if you have requested deletion of history entries, where the message displayed depends upon which one of the three history deletion options you have selected. In this case, the second option, prior to the beginning of the closing period, was selected.

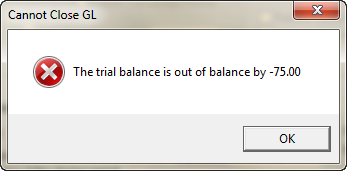

•The current balance of all accounts (including inactive and summary accounts) is summed, and you will be warned if there is an imbalance (the sum does not equal zero). If General Ledger is unbalanced, you will not be able to close the period.

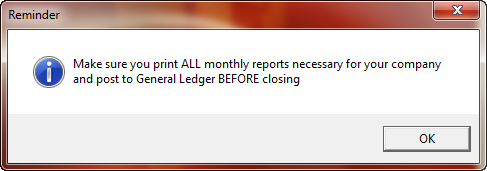

•You will be reminded that the primary financial reports should be generated, and that the General Ledger files should be backed up, prior to closing the period.

•A message is displayed to remind you that the printer must be ready to print the GL Journal report.

1. Select your Close option.

Period

▪When you close a period, current balances from expense and income accounts are accumulated in the net income account, and the expense and income statement account current balances are set to zero.

▪The net income account contains the total net income for the period.

▪The period to date balances for all accounts are also set to zero.

▪When you first open the Closing window, a series of tests are performed to verify that General Ledger is in the correct state prior to closing.

Period and Year

▪You close the year at the end of your fiscal year.

▪When you close, the Current Balance is set to zero for all Income Statement accounts, but retained for Balance Sheet accounts.

▪The Period-To-Date balance and the Year-To-Date balance are set to zero for all accounts.

2. Select your Delete History options.

▪Prior to the current year - Deletes all history entries prior to the current year (last year).

▪Prior to the beginning of the closing period - Deletes all history entries prior to the beginning of the closing period.

▪Prior to the beginning of last year - Deletes all history entries prior to the beginning of last year.

3. Set your AP Cut Off Date - the beginning date for future AP transactions.

4. Find the Accounts for:

▪Net Income Account

▪Retained Earnings Account

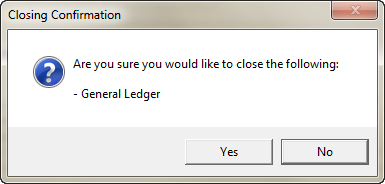

5. Click OK and the Closing Confirmation dialog will display. |

|

6. Click Yes in the Closing Confirmation dialog and the GL Close Processes will begin to run. Reminder / error messages may display.

▪You are warned if you have performed a release to General Ledger from Accounts Payable without updating General Ledger.

▪A reminder is displayed that the primary financial reports should be generated, and that the General Ledger files should be backed up, prior to closing the period.

▪You are warned if you have requested deletion of history entries, where the message displayed depends upon which one of the three history deletion options you have selected. In this case, the second option, prior to the beginning of the closing period, was selected.

▪The current balance of all accounts (including inactive and summary accounts) is summed, and you will be warned if there is an imbalance (the sum does not equal zero). If General Ledger is unbalanced, you will not be able to close the period and the Cannot Close GL message will display. Click OK to close the message and resolve the out of balance problem before rerunning the close process

▪The Current Balance is set to zero for all Income Statement accounts, the Period-To-Date balance is set to zero for all accounts.

▪Amounts for entries on the posted entry file are reversed, provided the entries require reversal. Voided entries from the unposted entry file are moved to the entry history file.

▪The unposted entry file, the posted entry file, the entry history file, the account file, the department file, the recurring entry file, and the account type file will be re-indexed and any records marked for deletion will be deleted.

▪A reminder that the printer must be ready to print the GL Journal Register report is displayed. Even though this dialog is always displayed, the report may not be generated.

•When closing the Year:

▪if any non-voided entries exist on the unposted entry file, you will receive a warning message and you will be prevented from closing the year.

▪The current year balances and current year budgets for all periods are moved to last year's balances and budgets.

▪The Year-To-Date balance is set to zero for all accounts.

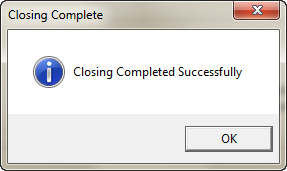

7. The Closing Complete dialog will display "Closing Completed Successfully" when done.

Click OK to return to the Close Period screen. |

|