Mod #419 Retail Invoicing System with EBT

The standalone "Retail Invoicing" mod is an invoice creation process that is driven by bar code scanning for use in a retail operation. It will extract the item's weight from the scanned bar code. entrée V4.1 supports Electronic Benefit Transfer (EBT) payments in this modification.

Updates

V4.5 Updated retail invoicing to provide the ability to set the Font size for Receipt printing in the Documents tab of System Preferences.

V4.1.3 Enhanced the standalone Retail Invoicing modification to include support for Electronic Benefit Transfer (EBT) payments.

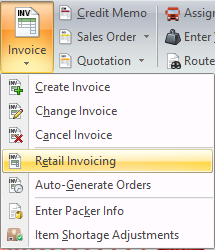

V4.1 •Access your retail customer invoices in the Customer ribbon > Invoice menu > select Retail Invoicing. |

|

V4.0.42 Updated so when trying to match the scanned UPC code it will now check for a match on the twelve-digit value of the secondary UPC code, if the check of the primary UPC code fails.

Other Retail Invoicing Mods:

▪Mod #633 Adds a feature for changing the Unit Price of items in Retail Invoicing.

▪Mod #656 Retail Invoicing Feature in Create Invoice with EBT Support.

▪Mod #761 Retail Invoicing Custom Receipt with Distributor information.

▪Mod #785 Retail Invoicing to Print 2 Copies of the Receipt.

▪Mod #866 Retail Invoicing to Requires All Weights on invoice.

▪Mod #947 Retail Price System - Date Driven.

▪Mod #980 Add Retail Prices to Copy Special Prices Utility.

▪Mod #987 Retail Pricing Defined with a Quantity Based Price.

▪Mod #1018 Retail Invoicing Feature Addition of Route, Stop and Fuel Surcharge.

▪Mod #1031 Retail Price may be entered in a text format.

▪Mod #1166 Retail Invoicing via Create/Change Invoice.

▪Mod #1406 Retail Invoicing - Features for Charges & Payments.

▪Mod #1424 Retail Invoicing Prints Type LZ Invoice instead of receipt.

entrée Settings for EBT

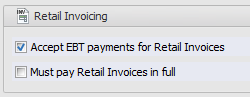

•Customer: Miscellaneous Tab Retail Invoicing options. ▪Accept EBT payments for Retail Invoices - Default is Yes. ▪Must pay Retail Invoices in full - Default is No. If you need to change or cancel the invoice for a customer with this option enabled use the Return to Invoice option and close the check out.

▪Click Apply to save it. |

|

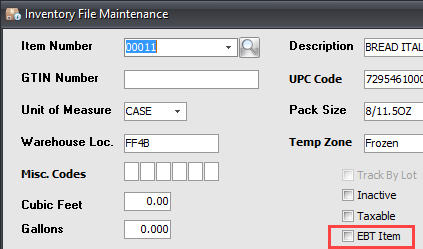

•Inventory: Retail Invoicing and Electronic Benefit Transfer (EBT) requires items to be updated in the Inventory File for EBT.

▪You must mark all the items that are eligible for purchase with EBT funds. Check the EBT Item option box in the item information area.

▪Click Apply to save it. |

|

Order Processing Overview

•entrée will not process EBT payments directly, it simply allows these payments to be correctly identified when applied to the invoice.

•Invoicing has been updated to suspend the application of Sales Tax on those items which are purchased with EBT funds.

entrée V4.1 Standalone Retail Invoicing with EBT

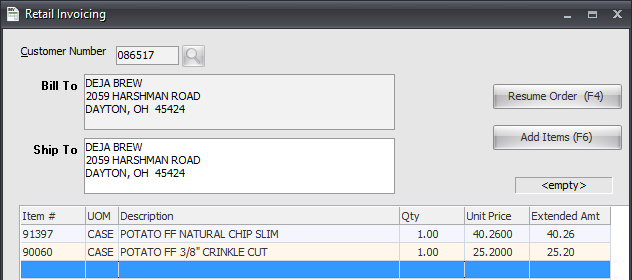

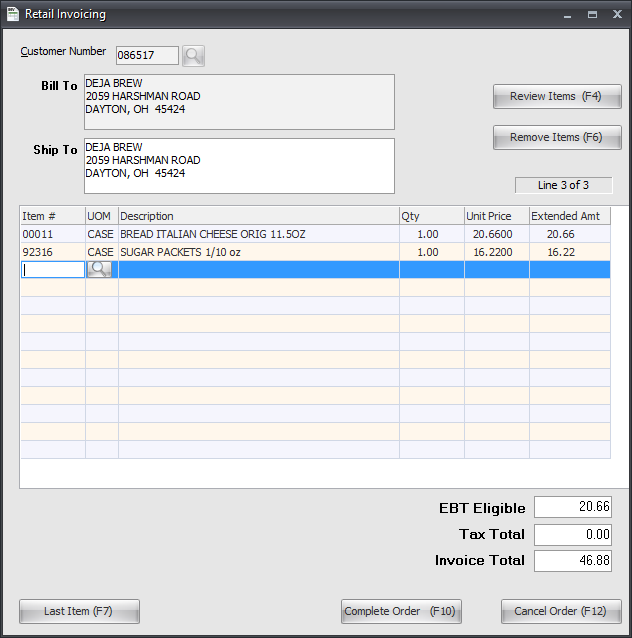

Buttons: The buttons displayed will change as the screen requirements change.

•Search ▪Customer Number ▪Inventory File in the Item grid

•Review Items (F4) - Closes the item # field and search tool in the item grid. •Remove Items (F6) - Select the item to be removed from the invoice and click it. •Last Item (F7) - Removes the last item in the grid. •Complete Order (F10) - Continues processing in the Check Out dialog.

•Cancel Order (F12) - Cancels the invoice in the system. |

|

•Resume Order (F4) - Opens the item # field and search tool in the next available row in the item grid.

•Add Items (F6) - Adds a new blue line in the item grid with the search tool and the item number field selected.

Totals

•EBT- Eligible: Retail Invoicing will display the EBT- Eligible amount which is the total amount of sales which can be submitted for payment by EBT. It will keep a running total for the EBT eligible amount and update the value throughout the retail invoice creation process as these items are added.

•Tax Total: This value will change when the application of Sales Tax on those items which are purchased with EBT funds is deducted.

•Invoice Total: Total due for the order.

Retail Invoicing Overview

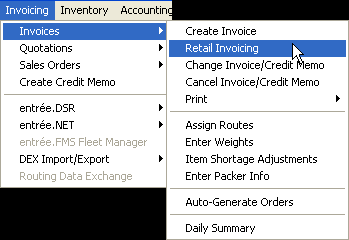

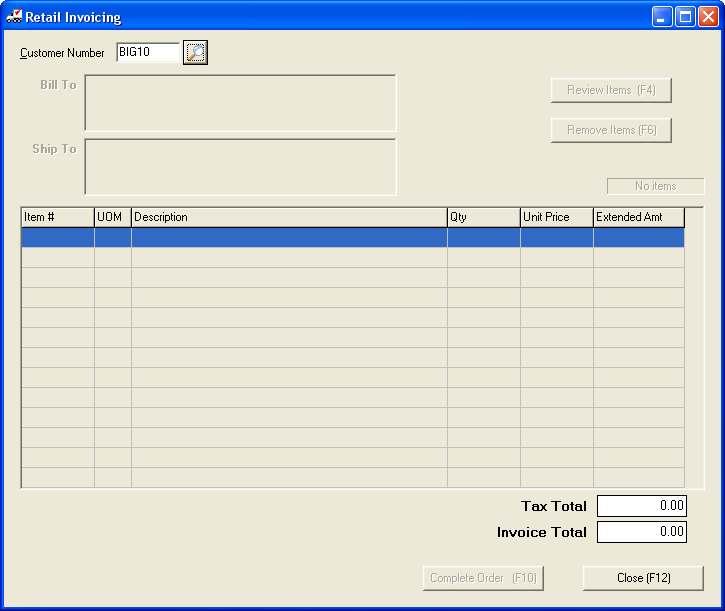

1.Go to the Customer ribbon > Invoice menu > click Retail Invoicing.

2.In Customer Number use the search tool to find your customer.

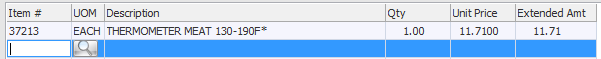

3.Scan items and they will be added to the grid.

4.Once all items are scanned in click Complete Order to proceed to Check Out.

5.Check Out Overview:

a. Enter values for:

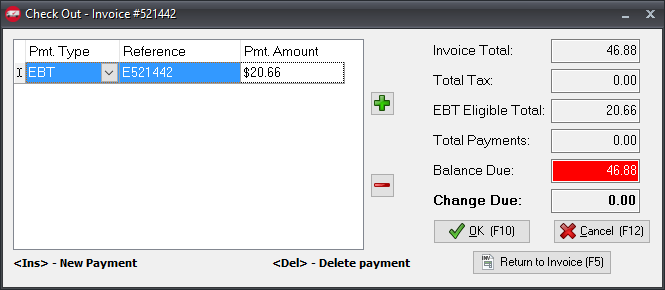

▪Pmt. Type: Select from Cash, Check, Credit Card or EBT.

▪Reference: Retail Checkout will automatically provide a default Reference value for each payment based on the payment type and the Invoice Number. The system will update the Reference value automatically only if you do not change it from the default. If you have edited the Reference value then the system assumes you have provided the value that you wish to use and it will no longer update Reference if the payment type changes again.

▪Pmt. Amount: Enter the amount for the selected Pmt. Type.

b. You must hit the Enter key after settings each of the three fields.

In the example below we selected the EBT payment first. The Balance Due on the retail invoice will be recalculated to exclude EBT payment and item taxes.

In the example below we selected the EBT payment first. The Balance Due on the retail invoice will be recalculated to exclude EBT payment and item taxes.

•When EBT is chosen as the Pmt. Type the invoice totals will immediately be recalculated and updated to assume that the full "EBT Eligible" amount will be applied.

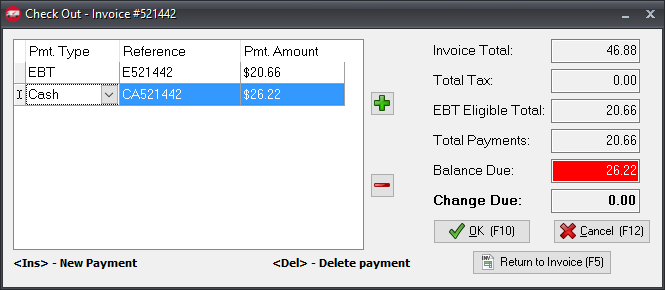

c. In Check Out to add another Pmt. Type click the green plus sign and enter the next set of payment values.

▪If the add does not work go back to the previous payment entry and in each field hit the enter key and click the green plus.

•Once entry of the EBT payment is complete the invoice will be recalculated based on the actual payment amount entered. The running total of the EBT eligible amount in the order is seen in the EBT Eligible Totals field.

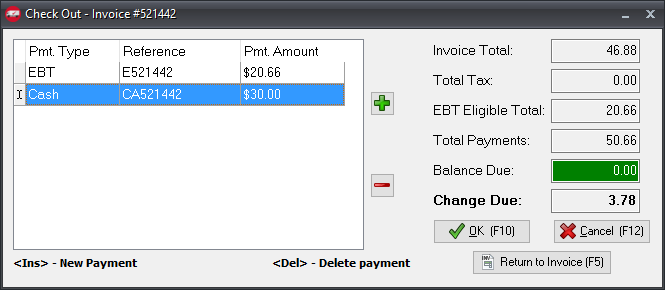

•In this screen we show the progression as a cash payment is added during Check Out. If there is any Change Due the value will be displayed.

6. Once the Enter key is hit on the last payment needed for the order you will see the Balance Due field turn green with zeros.

7. If the default payment is correct hit F10 or click "OK" to quickly complete the invoice. Click OK (F10) to check out the customer. Cancel (F12) this will cancel the current edits and cancel the invoice.

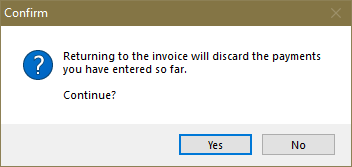

•Click Return to Invoice (F5) will cancel the current edits and go back to the invoice. •Back in the invoice you can add new items or removed items from the order.

|

|

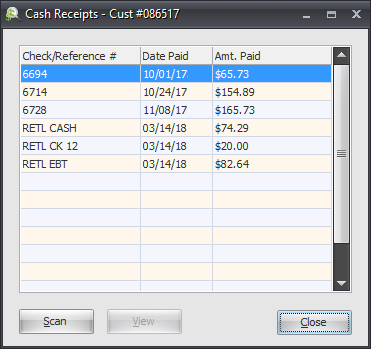

•What is in Customer Cash Receipts

For this example the Check Out screen Reference value were edited to show you the transactions in the report Check/Reference Number field.

|

|

EBT Reporting

Payments are recorded in the Cash Receipts, Deposit Slip and Tax reports. For the report examples below the the Check Out screen Reference value was edited to show you the transactions in the report Check Number field.

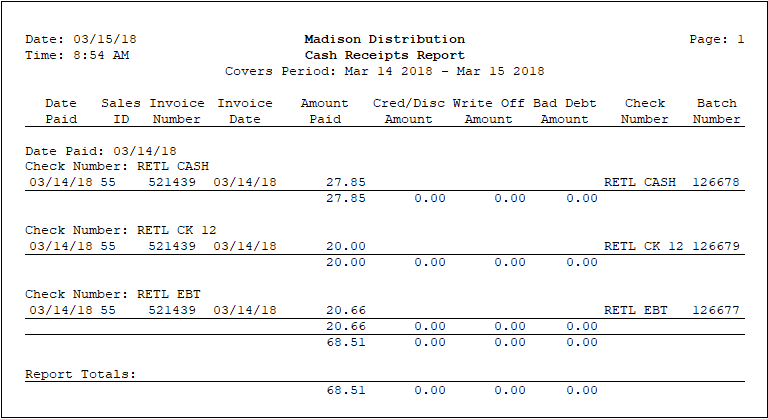

Cash Receipts Report

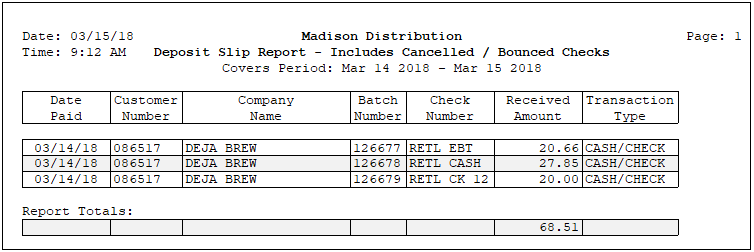

Deposit Slip Report

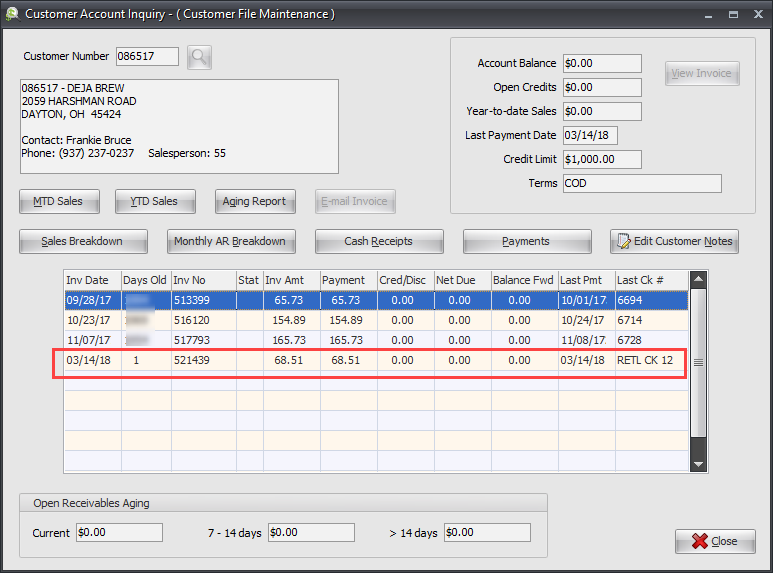

entrée V4.1 Customer Account Inquiry with Retail Transaction

For our example below instead of using the check number in the Check Out screen Reference field we used RETL CK 12 so it can be easily identified in the Last Ck # field.

entrée V3 •Access your retail customer invoices through the Invoicing menu.

•Review items, delete items, edit and complete the order. |

|

entrée V3 Standalone Retail Invoicing screen

V3.6.17 Revised the implementation of Modification #419 Retail Invoicing so that, in addition to playing the "System Asterisk" sound when an item is not found, a warning message will also be presented. The presentation of this message has been set up to ensure that the user cannot continue scanning until the message dialog has explicitly been dismissed by the user.

The

The