Fully Integrated Accounts Payable

The entrée.AP software module is an Accounts Payable system that fully integrates with your entrée software to manage your business expenses, including received Purchase Orders. entrée.AP provides the ability to generate checks, track credits, track discounts, track partial payments, track recurring obligations and reconcile your bank accounts. It also includes a flexible "Approve to Pay" feature which lets you view only the invoices that meet your criteria (vendor, discount date, invoice date, etc.) and approve them with just a click.

Posting from a Purchase Order

When closing a Purchase Order from the main entrée system when all inventory has been received and your cost and pricing properly updated, you have the option to post the transaction directly to entrée.AP. At this time you will be required to enter the vendor’s unique invoice number for the received goods. This time saving feature will reduce the number of steps for your purchasing and accounts payable departments, and ensure accuracy of the payments issued to your vendors.

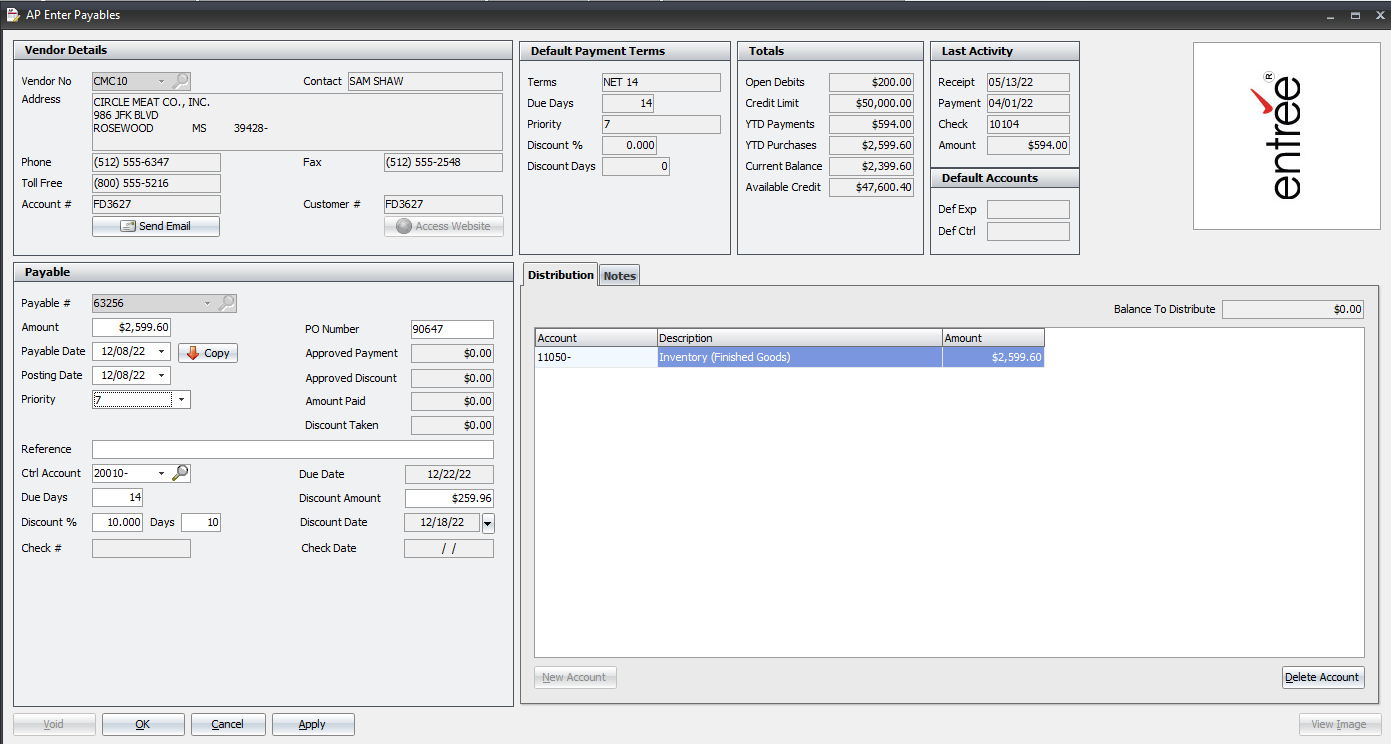

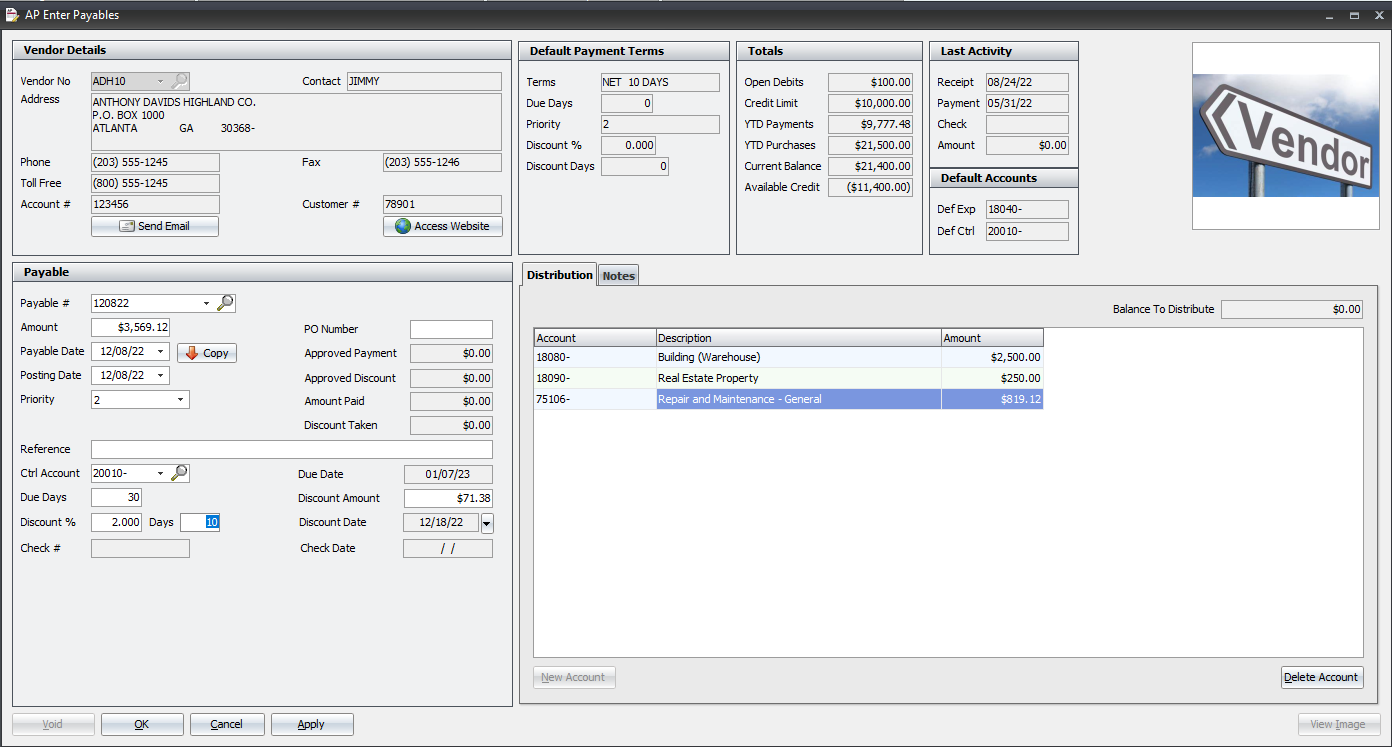

Payables Entry

With entrée.AP, you can enter payables, debits, calculate discounts and optionally approve the payable for payment. Once your vendor’s invoice is received, you can compare it to what was actually received on the purchase order, and then post it to entrée.AP with just one click. When posting a received and approved Purchase Order, the system will automatically use the proper information from both the Purchase Order and Vendor file. Just enter your payable number, and entrée.AP will automatically fill in the proper amount, payable date, posting date, priority, due days, discount, purchase order number, discount and all other account information. You also have the ability to distribute the payment amount to multiple expense distribution accounts when necessary.

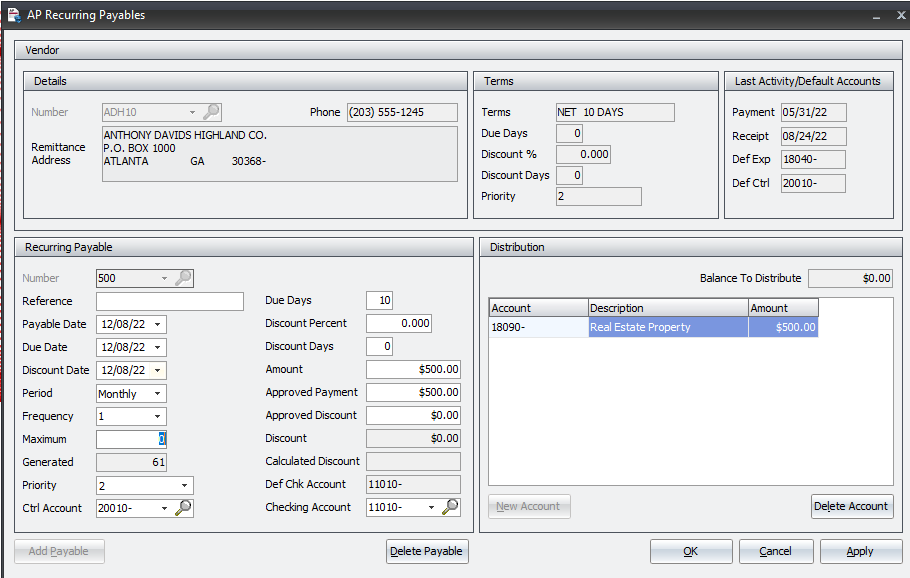

Recurring Payables

Some payables need to be created on a regular basis. Instead of entering those payables manually, you can create a recurring payable entry, and then use it to automatically generate the payables for you on a regular basis. Examples of recurring payables could be a line of credit payment, monthly invoice for rent or leasing of equipment. Frequency options for recurring payables include daily, weekly, bi-weekly, monthly, bi-monthly, twice a year, yearly.

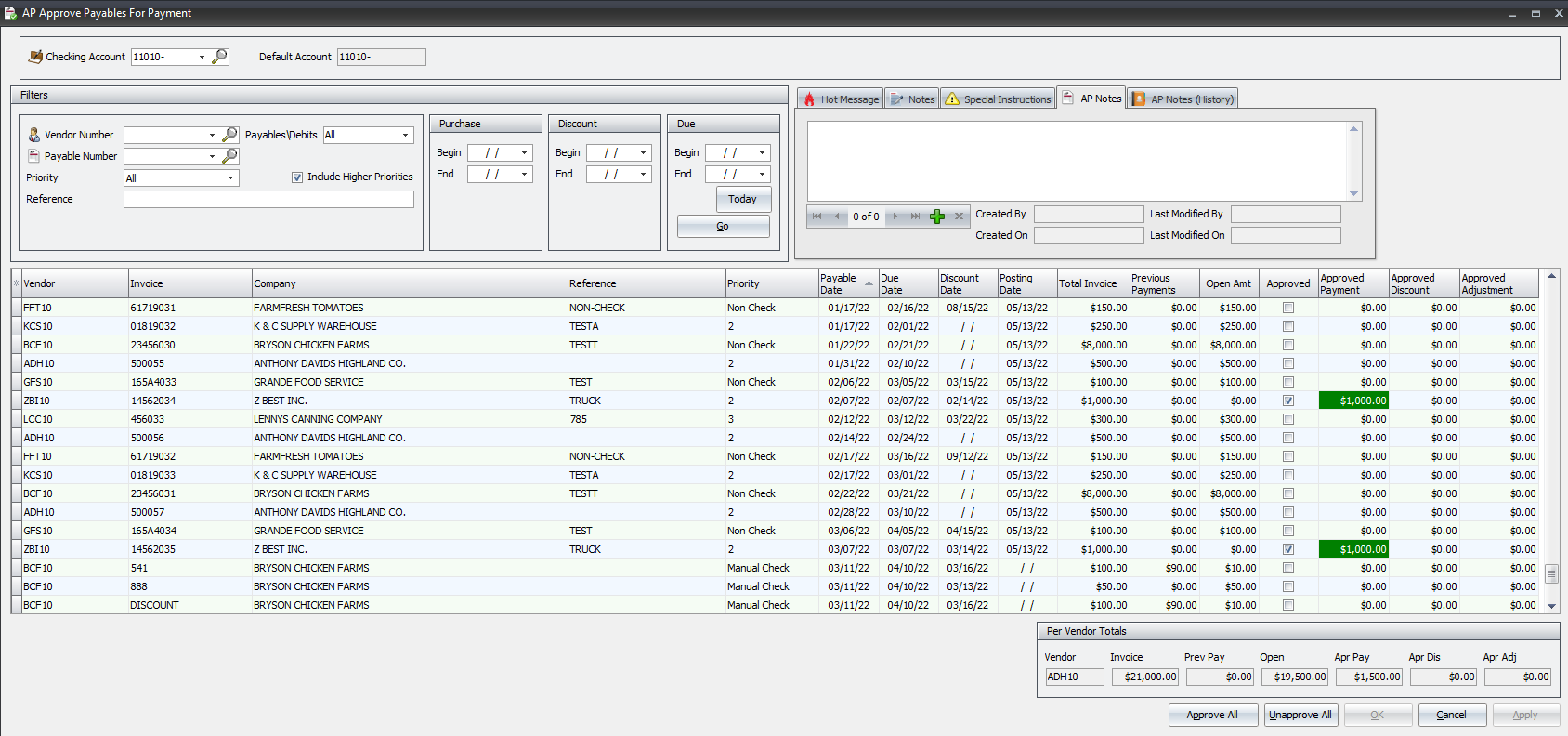

Approve Payables

Once you have created a payable, you must approve it for payment before you can generate a check. The entrée.AP system allows you to approve all your payables from one screen. You can either select a single vendor, or view all vendors when selecting which invoices to approve for payment. This option is also useful for displaying open payables that meet your entered search criteria. You have the ability to approve your payables by payable number, priority, purchase date, due date, and discount date. As you approve payables, entrée.AP will keep a running total per vendor with approved discounts and/or adjustments.

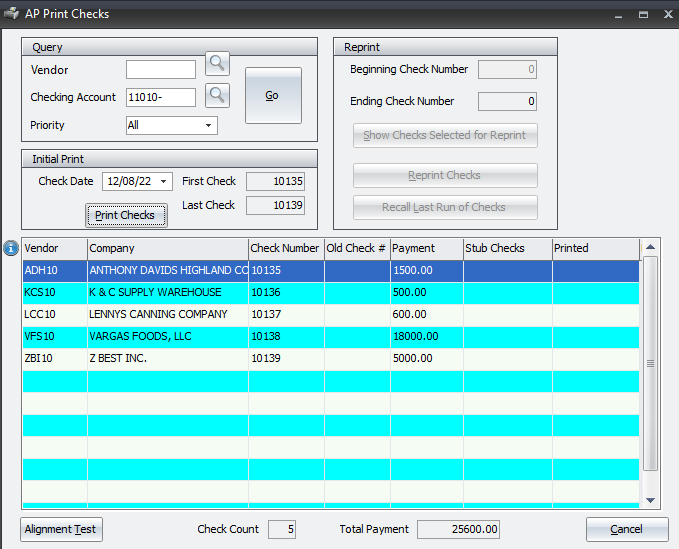

Printing Checks

Once you create your payables and approve them for payment, you can have entrée.AP generate checks and also void or re-print them if necessary. Checks can be printed using either a standard dot matrix printer or laser printer, and can print on plain paper or pre-printed check forms. You can also define the layout of your checks by using our check printing formatting tools. You can specify that checks print by vendor, checking account, and priority.

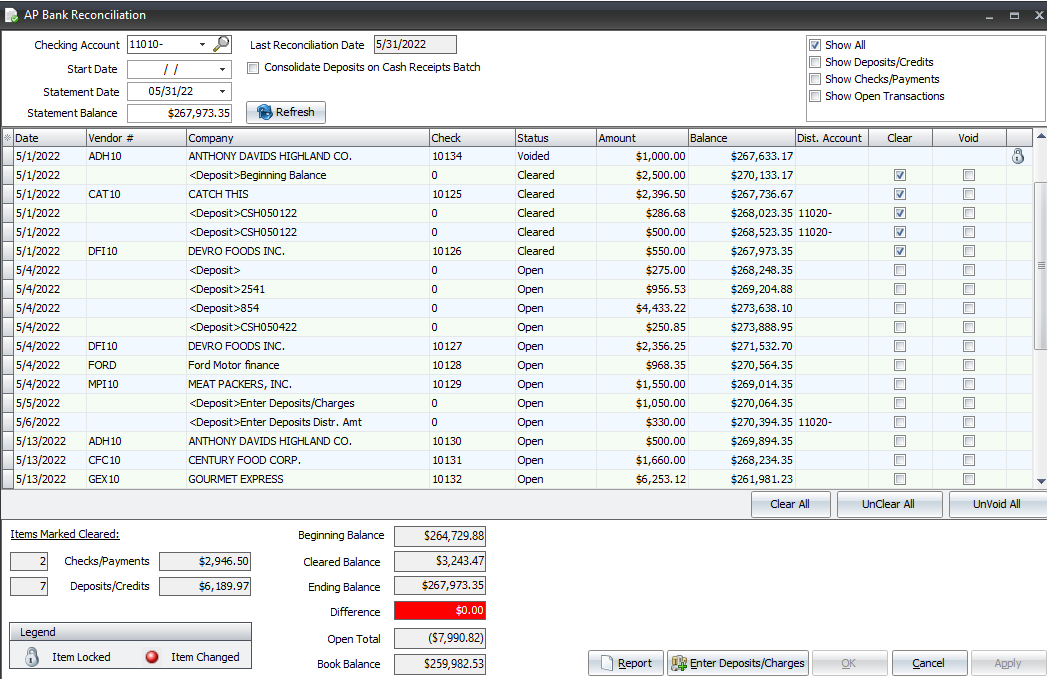

Bank Reconciliation

Bank Reconciliation allows you to reconcile your bank statements against information stored in entrée.AP. When you receive your bank statement, you can compare the statement to the reconciled transactions and voided checks, cleared checks, cleared deposits, and other charges. This ensures your checking accounts remain accurate with your bank. All your open transactions will be displayed with the ability to select multiple transactions. As you clear transactions, entrée.AP will display your running totals including Bank Balance, Open Balance and Book Balance.